The DailyTradr is for informational and educational purposes only. Nothing in this newsletter is financial advice, trading advice, or a recommendation to buy or sell any asset. Always do your own research and consult a professional before making financial decisions.

Jump to Section

Announcements

No announcements

Last Week in Crypto

Clarity Act for crypto received pushback

Bitcoin hovered around $95k range

Strong spot ETF inflows (1.4 billion on the week)

Ethereum stayed around $3,300 to $3,400 with strong staking demand

Last Week in Stocks

Major indexes saw all time highs earlier in the week

Market seemed unaffected by DOG probe into Fed Chair Powell

Slightly higher than expected CPI inflation data

Unemployment showed a slight decline

Gold and silver hit new record high prices

Opinion on Markets: There seems be some momentum suggesting that some smaller market cap stocks and undervalued plays will see more and more rotation from Mag 7 which have dominated the markets for years. I think there is a lot of people wanting to derisk but still want exposure to stocks if they keep going so this explains a lot of other stocks making moves as the big ones start to chop around.

Bitcoin

Got the expected push up above the range that was shared. Good demand and attention and price staying flat during a 3 day weekend it looks more likely for some upside.

Prediction: Seeing a lot of institutional buys and a lot of ETF inflows suggesting that larger players are wanting more. This also makes sense with the explosion of crypto stocks to start off the year hot. Mining costs are above the current prices which most use to make assumptions that price will go higher because they won’t sell for losses.

Ethereum

Strong narrative with staking showing how much is being staked and activity has continued to go up as gas fees stay low. Looking to see if we can break the key $3,400 level.

Prediction: The way it looks it seems there’s a good chance of this SuperTrend resistance breaking but all moves during the weekend especially a 3 day weekend are usually not to be trusted until we see the stock market open on Tuesday.

Total Crypto Market Cap

Great to see it holding above 3 trillion, and now holding 3.2 trillion strong. The next step would be to see us break through the SuperTrend resistance (red line) for confirmation.

🔥 Hot Markets

Materials - (This includes metals, mining, and basic metlas) - Showing a demand through precious metals and AI data centers needing copper.

Precious Metals & Mining: Still showing momentum

Energy - Continues to be a strong sector

Financials (New) - Strong bank earnings from Goldman Sachs and Morgan Stanley showing upward momentum

Crypto to watch

$CHZ - Strong weekly breakout candle on an increasing volume. Strong narrative during a World Cup year as crypto is getting momentum. Looks good for at least a 2x move to get back to end of 2024 prices.

Closed Trades

$XRP - Stopped at -12%

$UNI - Closed at 34%

$ROSE - Stopped out at -20%

$CRV - Stopped out at -23%

On-chain Projects

TRACKING WITH GURU

$BERRY on a 3 week winning streak and up 46%. Seems to be the clear winner of the microcap list.

Current Watchlist 5

$COR, $BERRY, $PAPPLE, $PROOF and $GURU

This Week in Stocks

Market will see if new talks of Tariffs surrounded Greenland talk with Europe has an effect when markets open Tuesday (closed Monday). Other than that a pretty boring week for news other than maybe GDP on Thursday which is expected to remain the same at 4.3%. Coming in higher might be a catalyst for upside.

MLK - Markets closed Monday (Monday, January 19th)

GDP (First Revision) (Thursday, January 22nd)

Consumer Sentiment (Friday, January 23rd)

🔥 Stocks to watch

Eyes on some stocks in different sectors like $IREN and $BKKT. Possibly get some additional REIT exposure if real estate catches some momentum. Energy/nuclear hot so looking in there as well and seeing if defensive plays have more room to run.

OPEN TRADES

$FLNC - Currently up 46%, high of 50%

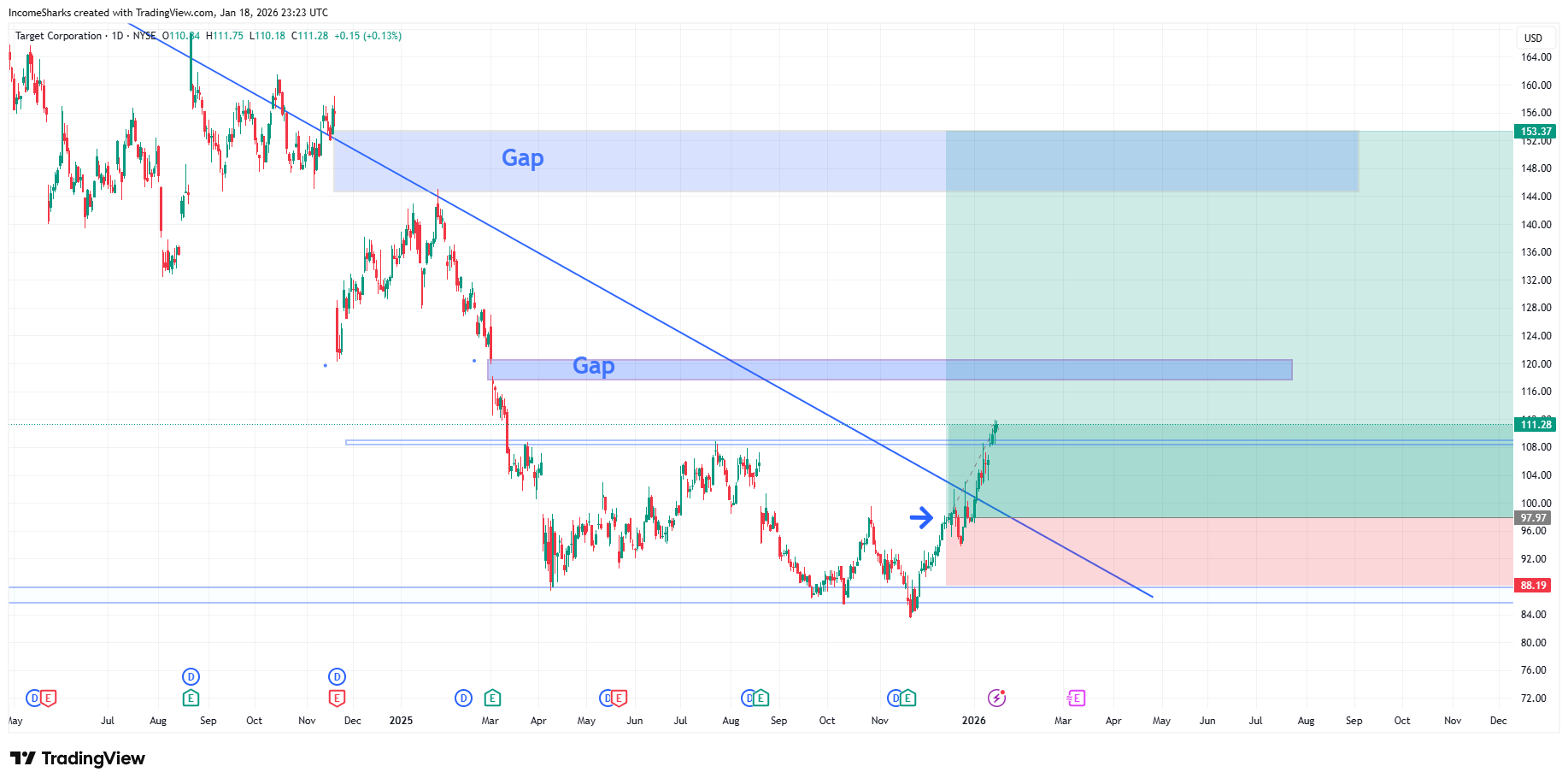

$TGT - Currently up 13%, high of 14%

CLOSED TRADES

$CROX - Closed at 6%

$SABR - Closed at -11%

$CAN- Closed at 111%

$DRD - Closed at 62%

$ROOT - Closed at -4.5%

$NGVC - Closed at -6.1%

$TGT - Closed at -12%

$TGT ( ▼ 0.76% ) (Target)

Up 13% going strong with strong demand in trading cards and over all still undervalued in its sector.

$FLNC ( ▼ 1.97% ) (Fluence Energy)

Strong stock, up around 50%.

DailyTradr Show

No episode this week

All charts were created using TradingView

The DailyTradr

Follow @dailytradr on X (Twitter) to give feedback, suggest content or creators you’d like to see featured, and to keep up to date.