The DailyTradr is for informational and educational purposes only. Nothing in this newsletter is financial advice, trading advice, or a recommendation to buy or sell any asset. Always do your own research and consult a professional before making financial decisions.

Announcements

No announcements

Last Week in Crypto

Double digit sell offs with major coins like Bitcoin 10 to 13% and Ethereum 15 to 18%

Saw some massive liquidations in crypto, making it the 10th largest crypto liquidation event

400 billion in marketcap value was lost

Fear and Greed Index is now in the single digits as maximum fear has peaked again. 18 puts us in the red which are levels we saw in April

Last Week in Stocks

The 3 Mag 7 stocks all beat earnings but two of them dropped with $MFST having a double digit sell off.

Fed held interest rates which was expected

Silver and Gold saw record setting corrections as much as 30% in a single day for Silver after setting all time highs

Government seeing a partial shutdown with a high chance of being back open on Monday when the house can approve the Senates vote

Trump has nominated Kevin Warsh to replace Powell as head of the Fed

PPI inflation data came in hotter than expected with the US dollar making a little bit of a rebound at the same time as the metals selling off

Opinion on Markets: It was expected to be a big week and a big week it was. There’s a lot to digest and a lot of directions we can go after this. There’s bearish scenarios of deflation that you can start thinking of, there’s bullish scenarios to say that the US dollar is coming back in strength, and there’s neutral or defensive plays to consider where you saw “Defensive” stocks actually outperform on the week (utilities and consumer staples). This next week will probably decide the direction for the rest of Q1 so strap in.

Bitcoin

Quite the bloody week as all eyes were on Silver and Gold until the massive sell off. The possible “good news” for Bitcoin is that it finally dropped to a level that most had considered an important are or even a key level to buy. Historically buying when the Fear Index has gone this low has worked out well and seeing massive liquidations usually signals some sort of bottom. The ugliest and darkest times often lead to the good times but if this support breaks you can expect lower prices and more blood.

Prediction: Nothing to predict, simply will watch this week to see if the bulls have any strength to save this support. If they don’t it gets ugly so time to see what happens. Hold off this level, survive the chaos, and I might actually be a buyer by the next newsletter.

Ethereum

After 2 supertrend rejections down it goes. Always so close to a breakout and recovery but never actually doing it. Now we are on to the final bullish hope, defending $2k and showing any sort of life.

Prediction: Not fun when resistances hold and supports keep taking us to lower and lower levels. But we didn’t get a 250% run last year without having nasty drops before. $2k really feels like the last hope.

Total Crypto Market Cap

We had the SuperTrend resistance and we lost the 3 trillion support. That was where I was feeling fine if we could defend it but seeing it break last week was a little worrisome and here we are now giving back almost all gains we had from April lows. Bitcoin already did it so most likely we correct back to April lows before people want to even look or touch Crypto again.

🔥 Hot Markets

Energy - Continues to be a strong sector. Think this has to be the #1 sector of the year even in a bear market.

Nuclear (NEW) - Department of energy will be investing billions into this sector, could see some stronger reactions this week or next

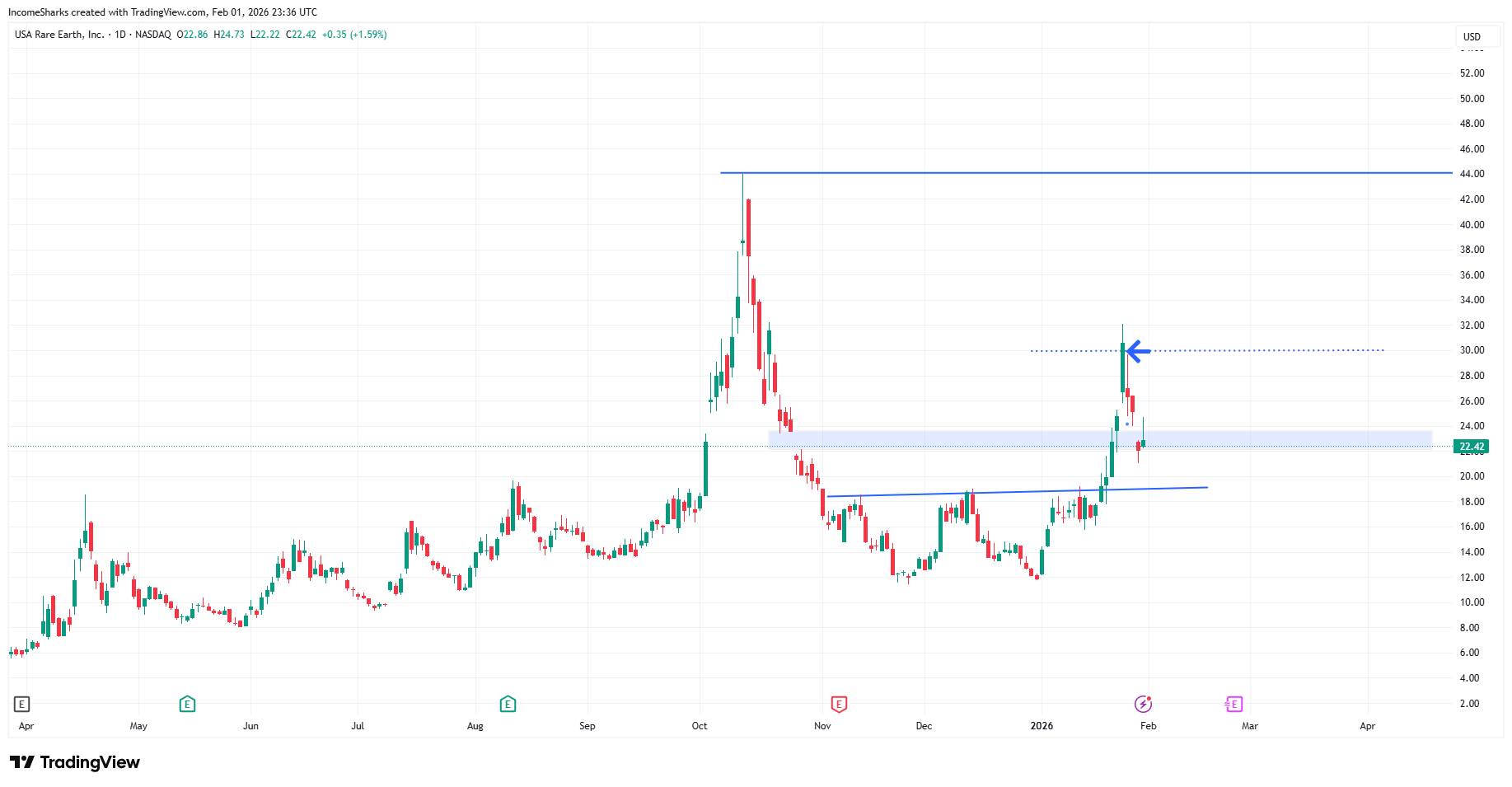

Rare Earth Minerals - The US government just took a 10% stake and invested billions in $USAR ( ▼ 4.31% ) which could ignite the rare earth metals sector.

Materials - (This includes metals, mining, and basic metals) - Showing a demand through precious metals and AI data centers needing copper.

Precious Metals & Mining: Possible blow off top, largest correction in history. Trillions wiped out in a day.

Crypto to watch

$CHZ - Went from looking amazing to basically back to entry. Almost seems like the move is to just hold and see if we can bottom on the majors.

Closed Trades

$XRP - Stopped at -12%

$UNI - Closed at 34%

$ROSE - Stopped out at -20%

$CRV - Stopped out at -23%

On-chain Projects

TRACKING WITH GURU

Berry still showing some hope but if $ETH can’t find support neither will these.

Current Watchlist 5

$COR, $BERRY, $PAPPLE, $PROOF and $GURU

This Week in Stocks

Expected a big week last week and oh boy was it big and not in a good way. A lot to unpack but next week has a chance to calm the markets down IF some earnings can start going in the positive direction. Another big week of earnings but a slower week overall other than US unemployment rate. If that shows a big rise we could start getting some more fear in the markets. All the earnings and dates are below.

US Unemployment Rate - Expected 4.4%, last read was 4.4% (Wednesday, January 28th)

Big Companies Reporting Earnings This Week

Walt Disney (DIS) - February 2

Palantir Technologies (PLTR) - February 2

Simon Property Group (SPG) - February 2

Tyson Foods (TSN) - February 2

NXP Semiconductors (NXPI) - February 2

Teradyne (TER) - February 2

Aptiv (APTV) - February 2

IDEXX Laboratories (IDXX) - February 2

PayPal Holdings (PYPL) - February 3

Pfizer (PFE) - February 3

Merck & Co (MRK) - February 3

PepsiCo (PEP) - February 3

Advanced Micro Devices (AMD) - February 3

Mondelez International (MDLZ) - February 3

Super Micro Computer (SMCI) - February 3

Take-Two Interactive (TTWO) - February 3

Uber Technologies (UBER) - February 4

AbbVie (ABBV) - February 4

Eli Lilly (LLY) - February 4

Novo Nordisk (NVO) - February 4

Alphabet (GOOG) - February 4

Qualcomm (QCOM) - February 4

Snap (SNAP) - February 4

Amazon.com (AMZN) - February 5

MicroStrategy (MSTR) - February 5

Bristol-Myers Squibb (BMY) - February 5

Philip Morris International (PM) - February 6

🔥 Stocks to watch

Closing both entries on $FLNC

OPEN TRADES

$FLNC - (Taking Profits) Currently up 75% (average of positions), high of 85%

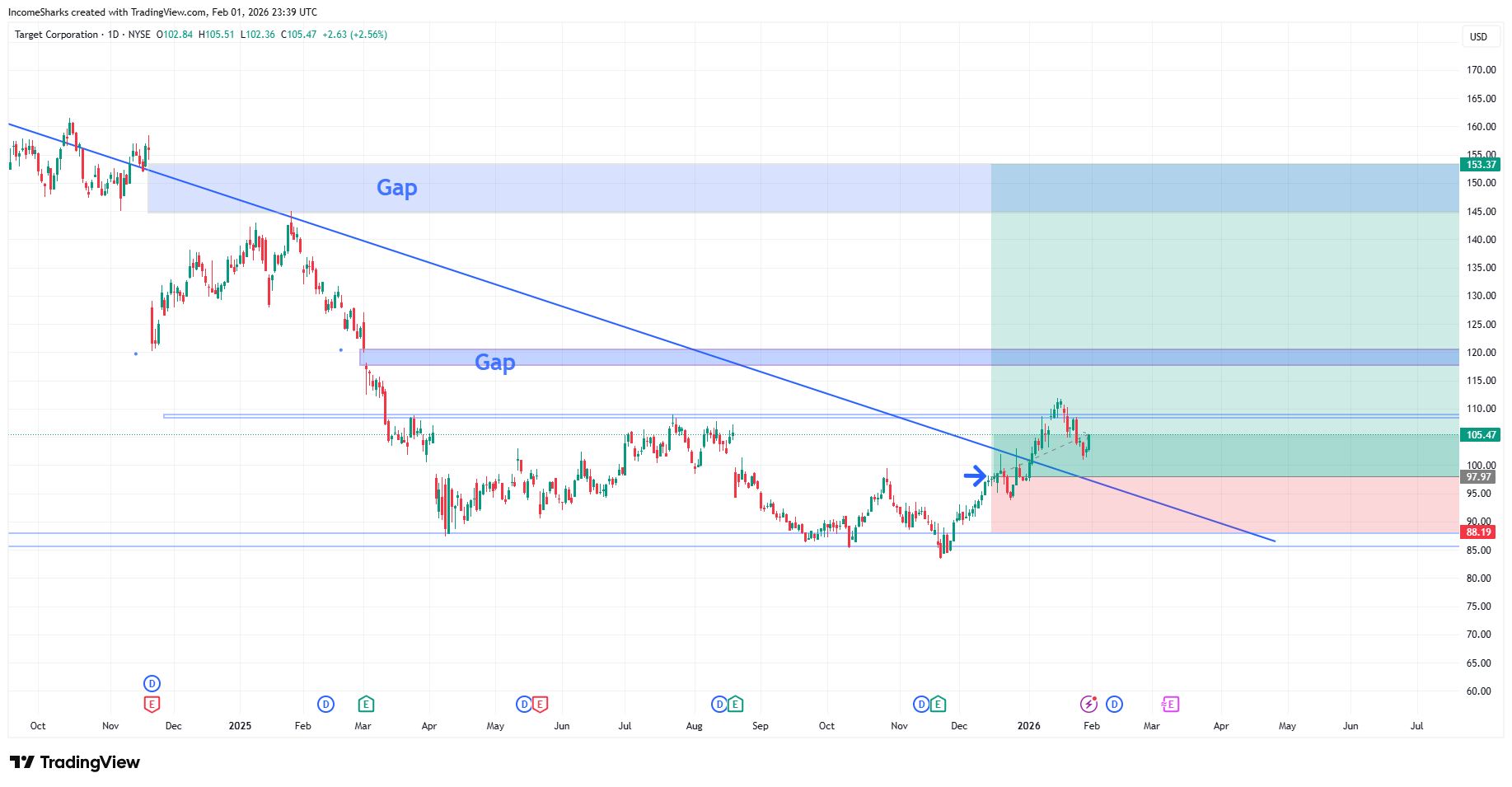

$TGT - Currently up 7.44%, high of 14%

$USAR - Currently down 24%, high of 5%

CLOSED TRADES

$FLNC - Closed at 65%

$FLNC - Closed at 85%

$CROX - Closed at 6%

$SABR - Closed at -11%

$CAN - Closed at 111%

$DRD - Closed at 62%

$ROOT - Closed at -4.5%

$NGVC - Closed at -6.1%

$TGT - Closed at -12%

$USAR ( ▼ 4.31% ) (US Rare Earth)

Still like it for upside, doesn’t help that Reuters launched some misinformation on the US invested stocks and then we had a terrible week for a lot of stocks. But rare earth isn’t going anywhere and I would almost be tempted to get a second entry.

$TGT ( ▼ 0.76% ) (Target)

Probably worth adding more to this trade. Defensive stocks might become a big trade as they were the top performers this week. A good hedge to stick to consumer staples that are undervalued as money rotates to safer plays.

$FLNC ( ▼ 1.97% ) (Fluence Energy)

Energy has been the play for a while and another monster week. Taking profits, hopefully will get back in at a lower entry. Just best to be overly conservative even on really strong plays like this. Almost a 2x in these conditions is a win. Also Earnings coming up February 4th so de-risking might be stupid but feels smart now.

DailyTradr Show

No episode this week

All charts were created using TradingView

The DailyTradr

Follow @dailytradr on X (Twitter) to give feedback, suggest content or creators you’d like to see featured, and to keep up to date.