The DailyTradr is for informational and educational purposes only. Nothing in this newsletter is financial advice, trading advice, or a recommendation to buy or sell any asset. Always do your own research and consult a professional before making financial decisions.

Announcements

No announcements

Last Week in Crypto

Bitcoin and most crypto currencies got hit hard, with $BTC dipping as low as $60,000 midweek before end of the week bounce back pushing it back to $70k.

One of the larger liquidation events taking out over 2 billion in liquidations in a day

Fear and Greed index having one of it’s lowest days, some as low as 5 setting records

Hundreds of millions in ETF outflows from the US

Global crypto market took out almost 700 billion in marketcap at one point

The good news? This very well could have been a capitulation event that gets us close to a crypto bottom. Rare to have this many bad headlines and records and it not historically be a good place to start considering buying

Last Week in Stocks

Dow Jones Industrial Average (DJIA) closed above 50,000 for the first time ever

The S&P 500 ended the week roughly flat after filling an upper gap that was created earlier.

The Nasdaq fell 1.9%, it’s worst weekly drop since late 2025

Tech and Software sell off led to some big names dropping double digits

Big winners of the week were value and small cap stocks that were part of defensive, energy, and consumer staples

Overall a very volatile and fear led week with what seems like a lot of risk off ending the week with the classic pump for those taking advantage

Opinion on Markets: A wild week to say the least and I think if you had a plan or thought you knew what to think that might have changed. The best news of all is this week of action was always looming and we got it out of the way earlier in the year. I’m sure most feel this is just the start or it could lead to more selling but I think the bigger picture is becoming more clear. We’ve had a wild run on tech and software for a while and I think the Mag 7 will no longer be as big this year. This is great news for the small to mid cap stocks and the indexes are already showing this. Crypto needs to find a way to re-attach itself from moving with tech stocks and find a way to start the narrative that it’s a lower cap play and high beta play that can take advantage of the rotation. There are also going to be sectors that become more obvious this year and those are already showing strength which are defensive stocks, consumer staples, energy, and some other like healthcare, construction, and utilities.

Bitcoin

If this wasn’t a capitulation week I don’t know what more it could look like. Tech stocks had a terrible week, precious metals had wild corrections, and overall it was just a week of fear that really got to crypto holders. Now that the dust is settling it does feel like that was probably the final big sell off and we are now getting closer to a bottom/area where the sellers are truly exhausted. We were being teased for a while above $80k that it could hold but once that broke and the $76k support broke all hell broke loose. The good news is that when the flood gates open we get to see where naturally it likes to fall too.

Prediction: Since we broke through two major supports in a week it’s safe to say that this recent one should hold for a while. We could still go lower but this should be a “sticky” area for a while. I don’t think you need to rush in to buy yet even if you like these levels and I think coming up with a buying plan if you believe in it long term is more important. Right now you need to be in spectator mode so my prediction right now is to just watch. We have $76k as the first hurdle to reclaim.

Ethereum

Supertrend resistance turned out to be a great warning near $3,400. But the $2,600 support got cut through like butter and so did the $2,220 level. Demand finally showed up at $1,800 and now we are going to see if $2k can be reclaimed and held.

Prediction: Bitcoin swept the April lows, Ethereum hasn’t yet. That would be a move down to $1,400 if it follows so I’m being more patient on this one over Bitcoin. $2k will be a level to watch this week. I’m a buyer lower because of those untested levels.

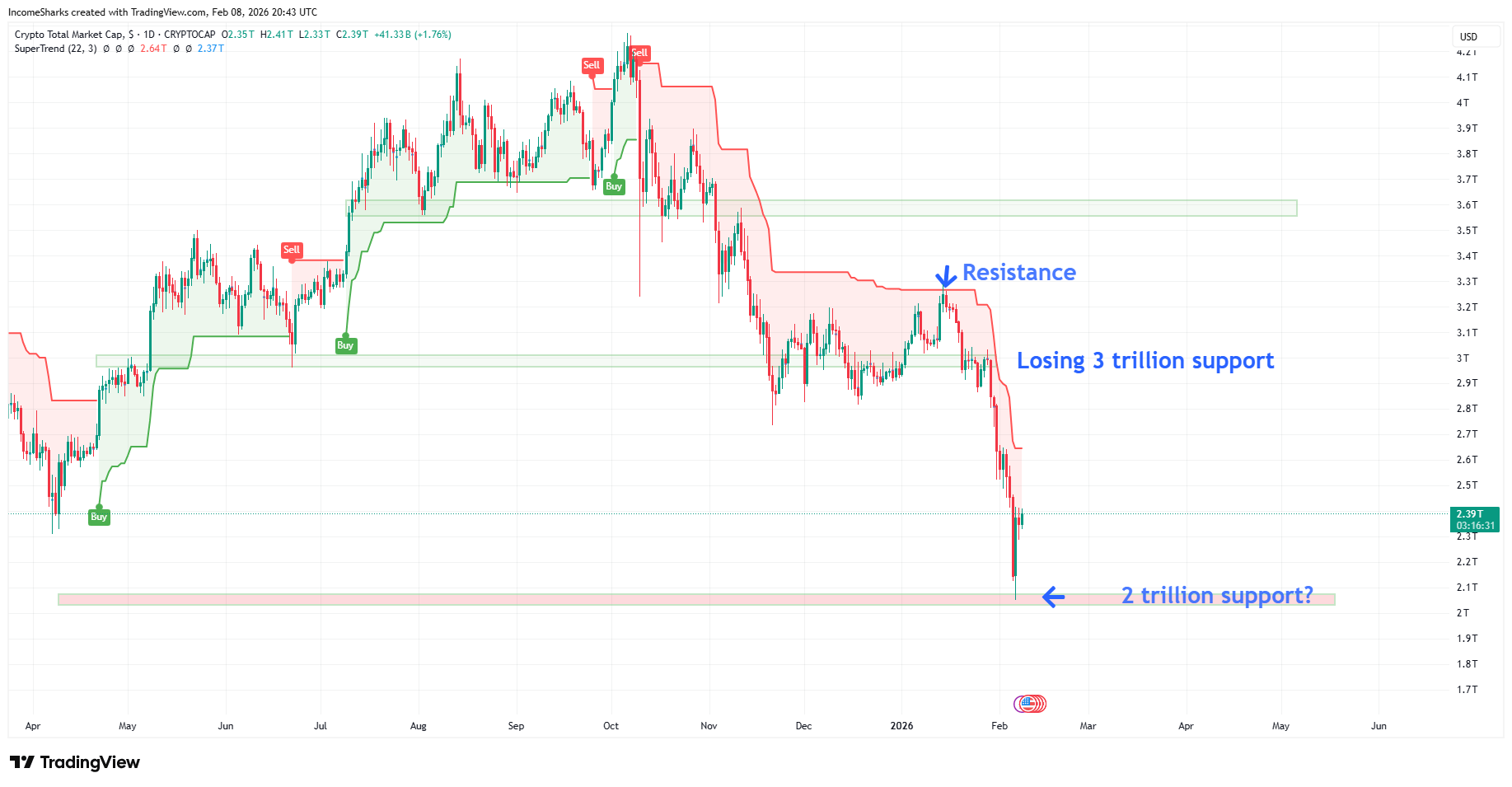

Total Crypto Market Cap

The SuperTrend resistance was really the warning sign to stay out. And the 3 trillion support breaking was the final warning to exit. But now that we’ve seen a trillion dollars wiped out in a few weeks it’s probably time to expect a rally or bounce. It doesn’t mean we don’t still get some follow through on the selling but that was the violent sell off the market has been dreading but we might have just got through the worse. 2 trillion global marketcap seems incredibly important now. Back to a trillion could still be a support but that really invalidates a lot of bullish long term ideas.

🔥 Hot Markets

Energy - Continues to be a strong sector. Think this has to be the #1 sector of the year even in a bear market.

Nuclear - Department of energy will be investing billions into this sector, could see some stronger reactions this week or next

Consumer Staples (NEW) - One again we are seeing more defensive stocks and sectors outperforming tech and software. These have the chance to be both a safe haven but also a way to make money.

Rare Earth Minerals - The US government just took a 10% stake and invested billions in $USAR ( ▼ 4.31% ) which could ignite the rare earth metals sector.

Materials - (This includes metals, mining, and basic metals) - Showing a demand through precious metals and AI data centers needing copper.

Precious Metals & Mining: Possible blow off top, largest correction in history. Trillions wiped out in a day.

Crypto to watch

$CHZ - Had a nice 38% run before the markets puked and now down 10%. Still like it and the narrative and a crypto rally would send it back pretty quickly.

Closed Trades

$XRP - Stopped at -12%

$UNI - Closed at 34%

$ROSE - Stopped out at -20%

$CRV - Stopped out at -23%

On-chain Projects

TRACKING WITH GURU

$BERRY continues to outperform and even during the blood found a way to finish green on the week. Seems like this is consistently the winner during the down period of onchain.

Current Watchlist 5

$COR, $BERRY, $PAPPLE, $PROOF and $GURU

This Week in Stocks

Earnings week is unwinding and I think people are ready for the volatility and pain to stop depending on the stocks they hold. This should be a week that’s more focused back on the economy looking at job numbers, unemployment, and we have a CPI reporting to give a clue about inflation again. True Inflation is already showing us declining and this week that might make headlines again as it’s already reported to be a decrease this week so a bigger decrease than expected might get people talking about another fed rate cut.

Fed Governor, and fed President Speaks - (Monday, Feb 9th)

US Unemployment Rate - Delayed last week, expected 4.4% from 4.4% (Wednesday, Feb 11th)

Core CPI - Expected 2.5% from 2.7% (Friday, February 13th)

🔥 Stocks to watch

$CLX ( ▲ 0.2% ) (Clorox) NEW -

Defensive consumer staple play that does more than just cleaning products. They own a lot of other food and consumer products from Burts Bees to Charcoal to Ranch Dressing. Chart looks good on a breakout and they got past their earnings so that’s not looming until May again.

OPEN TRADES

$TGT - Currently up 18.44%, high of 19%

$USAR - Currently down 24%, high of 5%

CLOSED TRADES

$FLNC - Closed at 65%

$FLNC - Closed at 85%

$ROOT - Closed at -4.5%

$CROX - Closed at 6%

$SABR - Closed at -11%

$CAN - Closed at 111%

$DRD - Closed at 62%

$NGVC - Closed at -6.1%

$TGT - Closed at -12%

$USAR ( ▼ 4.31% ) (US Rare Earth)

The timing with the markets dumping wasn’t ideal for the entry but fundamentally nothing changes for me. Could even consider another entry down here if willing to wait for either blue box to take profits.

$TGT ( ▼ 0.76% ) (Target)

Probably worth adding more to this trade. Defensive stocks might become a big trade as they were the top performers this week. A good hedge to stick to consumer staples that are undervalued as money rotates to safer plays.

$FLNC ( ▼ 1.97% ) (Fluence Energy)

Worked extremely well taking profits when we did. Now can spectate and consider when/where to get back in.

DailyTradr Show

No episode this week

All charts were created using TradingView

The DailyTradr

Follow @dailytradr on X (Twitter) to give feedback, suggest content or creators you’d like to see featured, and to keep up to date.